August 2023 Restaurant Industry Insights

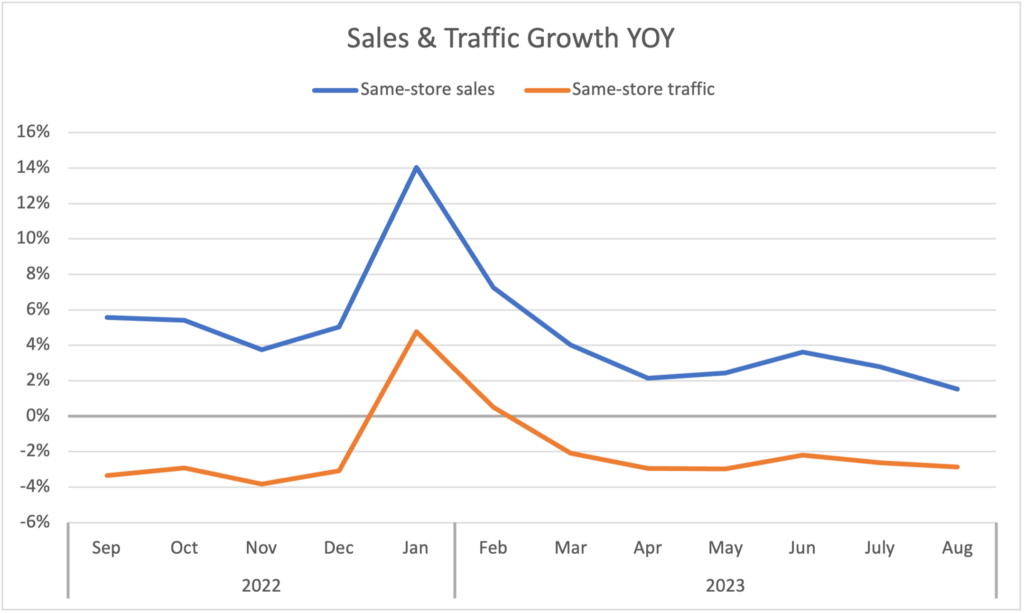

The latest data shows the feared slowdown in restaurant sales and traffic growth predicted for the second half of the year seems to be now upon us. Starting with June, every ensuing month has experienced softer year-over-year (YoY) same-store sales and traffic growth than the one preceding it. It appears that all the hardships consumers have been under are finally catching up with them. And now, on top of battling inflation and mounting credit card debt amid historically high-interest rates, millions of consumers will have to dedicate a significant amount of money each month to start paying off their student debt again. Data from September revealed many are already making those payments, and GuestXM data for September shows restaurant sales and traffic are taking another tumble this month.

Same-store sales growth was 1.5% for the industry during August, which represented a 1.3 percentage point drop from July’s growth and the weakest YoY growth since July of last year. In the case of same-store traffic growth, it was -2.9% in August, a slowdown of only 0.2 percentage points relative to the previous month’s growth rate. August saw the worst performance for the industry based on traffic growth in the last three months.

But clearly, the sharp decline in sales growth in August was mostly the result of rapidly declining guest check growth, while traffic was able to hold better than sales. Average check grew by only 4.8% YoY in August, the lowest it has been since January of 2021 when the industry was still lapping over the pre-pandemic period. With inflationary pressures easing and many restaurant companies stating a more conservative approach to menu price increases this year, the expectation continues to be for a further decline in average check growth, which will result in sales getting less of a lift from price and putting more pressure on traffic to accelerate growth.

The segments that are best positioned to succeed in this challenging environment for consumers continue to be quick service and fast casual, which saw the best same-store sales growth results during August and are expected to continue to outperform in months ahead as more guests opt for lower-priced options for their “food away from home” meals amid an economic slowdown.

Generational Shift Has Reached the Restaurant Industry

The COVID-19 outbreak and the ensuing behavioral and regulatory adjustments have significantly impacted the economy in countless ways. Fundamental shifts have occurred in both consumption and work behaviors. The ways that a generational transition has influenced these changes, however, are sometimes overlooked in the conversation. In many ways, COVID-19 can be seen less as the cause and more as the catalyst and accelerant of demographic inevitabilities.

Experts can debate economics, geopolitics, and the rate of technological innovation over the next few decades, but what remains undeniable is that the number of working-age adults in the US among current citizens is declining. Baby boomers, the largest generation in American history (76 million total births), are retiring. Meanwhile, Gen Zers (68 million total births) are beginning to join the workforce. This generational baton-passing will have profound consequences and can already be seen within the restaurant industry.

Gen Z Dominates Hourly Workers

“The Great Resignation” certainly factored into the industry’s staffing woes, which still hasn’t recovered to its pre-pandemic levels. But the retirement of the most populous generation combined with their increased life expectancy, will potentially increase the ratio of restaurant goers to restaurant workers, which could be far more consequential and lasting.

This shift is already noticeable in non-management restaurant positions. According to GuestXM’s Workforce Intelligence data, in 2023 Gen Zers represented 57% of full-service restaurant hourly positions and 71% of limited-service hourly. While younger workers have always formed a very large portion of hourly restaurant workers, this number is surprising given that this already high percentage is expected to grow within the next several years as the younger cohort of the generation enters legal working age.

Sentiment Surrounding Gen Z

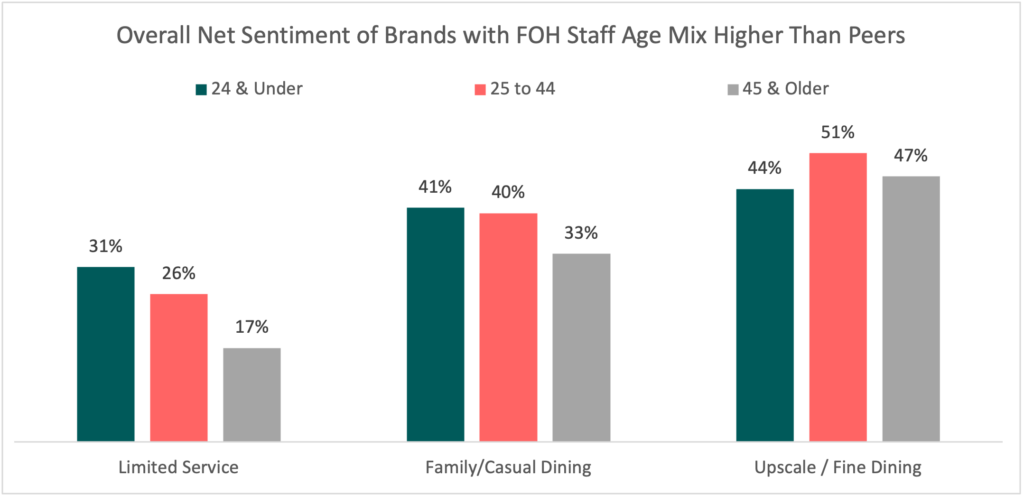

How are guests responding to this new workforce through their online restaurant reviews? Digging deeper into GuestXM’s workforce and guest data reveals that attitudes depend on the restaurant segment. Brands that have a higher mix of younger workers compared to their peers scored noticeably better overall in Net Sentiment among limited-service restaurant brands, marginally better in family and casual dining, and worse in upscale casual and fine dining.

On an industry level, brands with an older front-of-house staff score higher in experience, attentiveness, and friendliness. When it comes to speed, however, it is not surprising that the restaurants that tend to have a larger mix of young employees outperform their competition.

Impact on Reviews

This generational shift may also be having an impact on guest sentiment scores. According to a PYMNTS report, Gen Zers are much more likely to leave negative reviews at restaurants. Baby boomers, Gen X, and millennial reviews are 82% to 87% positive and only 6% to 12% negative, while Gen Z reviews are 69% positive and 15% negative.

As Gen Z matures and becomes not only the dominant hourly worker within the restaurant industry but an even larger part of the consumer base, it will become critical for brands to understand this new generation.