May 2023: Restaurant Sales Growth and Traffic Trends

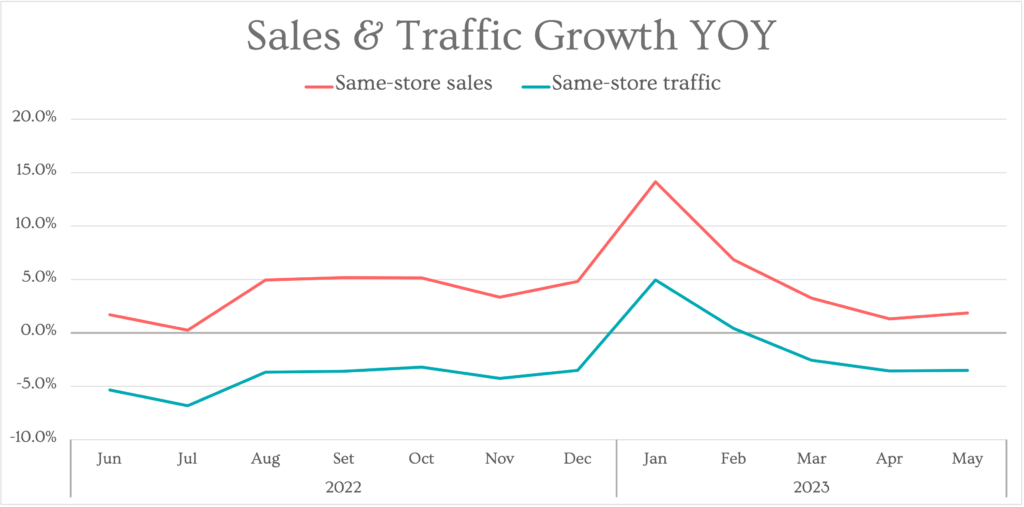

After experiencing a softening in year-over-year (YoY) growth during every month since January, restaurant sales growth improved during May. However, the upswing was relatively small, did not come from a substantial increase in guest counts, and the industry is still experiencing an erosion in sales performance compared to recent months.

Restaurant same-store sales growth was 1.9% during May, up from 1.3% the previous month. The comparison to Q1 performance is tricky because the favorable Omicron lap created unusually strong growth rates during the first months of this year. But what is clear is restaurant sales growth is not as strong as it was during the last months of last year, immediately before the Omicron boost came into effect. As a comparison, restaurant same-store sales growth averaged 4.4% for the months included in Q4 2022.

However, despite consumers continuing to battle significant inflationary headwinds, and the continued concerns for a slowing economy, the slowdown in sales growth is not coming from an erosion in traffic growth but rather from a deceleration in average check growth. But the news is far from positive when it comes to traffic growth. YoY traffic growth remains persistently negative, as it has for many years. Same-store traffic growth was -3.5% during May, an uptick higher than the -3.6% reported for April. Performance for the industry is not very different than the average -3.7% traffic growth recorded for the months during the last quarter of 2022.

Average guest check growth has been moderating in recent months, largely due to menu price increases decelerating this year. Average check grew by +5.8% year over year during May, up modestly from 5.2% the previous month but significantly lower than the average 8% for the last three months of 2022.

Evolution of Off-Premise Dining: From Marginal to Essential

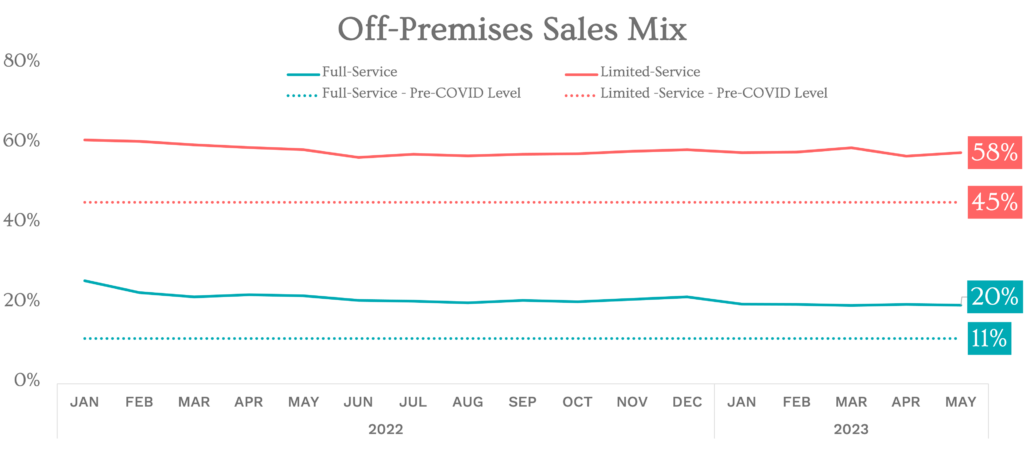

Off-premises was once a marginal revenue stream in full-service dining. By 2019, it accounted for only approximately 10% of sales. But the pandemic changed this. Restaurants had to frantically shift their operations away from their bread and butter: dine-in. From April until December of 2020, off-premises dining accounted for 44% of all sales. As a result, an ancillary option became an essential part of the business.

While no one expected the off-premises sales mix to remain at those historic levels, restaurateurs, especially those working in full-service brands, are now left wondering what off-premises will look like going forward.

Steady State Off-Premises Dining in the Restaurant Industry

Over-premises YoY sales growth has been down for full-service brands in recent months. This was to be expected in January and February as we lapped Omicron, a period that favored off-premises eating. However, according to data from Market Intelligence by GuestXM, even April and May were down 7.9% and 7.6% respectively for full service. Both delivery and to-go channels are down in the 2023 year-to-date (YTD) for full service.

Despite this recent negative growth, it appears that off-premises has settled into a new post-pandemic equilibrium. For over a year now, levels have been consistent. 58% to 60% of limited-service sales and 20% to 22% of full-service sales are off-premises. Moderate fluctuations and seasonality aside, it appears that off-premises has reached its new normal.

Investing in Off-Premises: A Strategic Imperative for Restaurants

Although Black Box Intelligence is neither bearish nor bullish on off-premises mix shifting dramatically in the near future, we still advise investing in this channel. Online evaluations are more significant than ever, as was stated in our analysis from February on restaurant sales and traffic trends. Restaurants that improved their average star rating saw their traffic increase by 3% over three years, while those with a negative change had a 1-point decrease in traffic. Off-premises reviews are typically far more unfavorable than those for dine-in experiences.

Consumers today are a lot less understanding than they were early in the pandemic when it came to full-service restaurants’ off-premises challenges. These new expectations are reflected in their harsher reviews. According to Market Intelligence by GuestXM, in Q1 of 2023, both delivery and to-go recorded negative net sentiment ratings for full service (limited service was only mildly better). Unfortunately, for many brands, Google and Yelp do not discriminate reviews by where the meal is eaten. And with the sales mix being nearly double what it was before the pandemic, these reviews can drag down a brand’s star rating considerably, which in turn can extend their negative effect to dine-in sales.

Although off-premises growth has slowed since the pandemic, it remains a crucial and constant aspect of the post-pandemic restaurant experience, and brands who make the right investments will reap the rewards.