Restaurant Industry Snapshot™ – August 2021

August Slump: Restaurant Sales Hit by COVID Spike and Consumer Confidence Decline

Restaurant sales lost some ground during August amid a spike in COVID cases and its negative effect on consumer confidence. Sales growth was 6.1% during the month; a 2.1 percentage point drop compared to July. Traffic growth was -5.4% during August, a 1.6 percentage point decline from July. Sales growth was the lowest recorded since 5.8% posted in May and traffic results were the worst for the industry in the last 3 months.

The industry is relying on larger-than-usual growth in average guest checks to propel sales into positive territory. Average check grew by 4.5% year over year in August. On a 2-year basis, the average check grew by 13% during the month. Average check grew by only 3.2% in all of 2019.

Sales growth was 11.8% for limited-service restaurants in August, an improvement of 0.8 percentage points compared to July. Meanwhile, full-service experienced a sharp downturn with sales growth at 2.4% in August, a drop of 3.8 percentage points compared to July.

Regional & Market Performance

Sales results are relatively strong in most states. 44 states posted a positive sales growth rate during the month, and 30 states achieved a growth rate of 4% or more. The best-performing regions were the Southeast, Florida, the Western region, and California. All top-performing regions had sales growth better than 7% or more. The worst-performing regions were the Southwest, New York-New Jersey, and New England, which all posted sales growth of 2.6% or lower.

The Southwest took the biggest hit with Ida making landfall in Louisiana at the end of August. Restaurants lost 27% of their sales that week resulting in a sales growth rate of -4.6%, a huge 20 percentage point swing compared with the state’s 15.6% sales growth recorded for July.

*2-year comp sales and traffic (only applies from March 2021)

The Restaurant Workforce

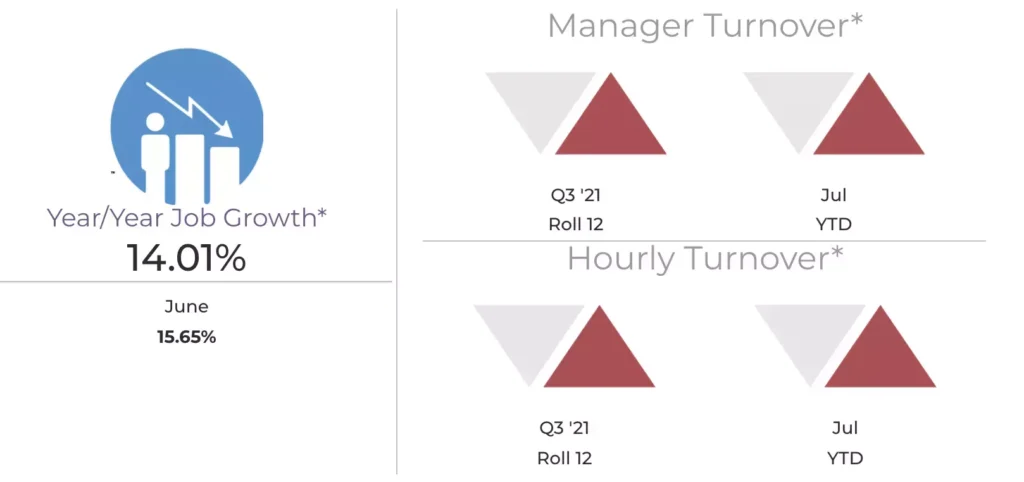

Job growth & turnover

The biggest challenge threatening the industry today remains the staffing shortage, which is complicating restaurant execution and resulting in declining guest sentiment in recent months. One of the prevailing theories behind the crisis has been that the expanded federal unemployment benefits have been providing incentives for people to not return to the workforce. But early Black Box Workforce Intelligence™ data for Mississippi and Missouri (states that chose to end these benefits earliest in the US on June 12) shows there was only an uptick in restaurant staffing levels in those states through the end of June and not the surge that was expected. This mirrors what has been reported for other industries.

A recent study published in partnership with Snagajob based on a survey of almost 5,000 hourly workers revealed there are 4 main reasons employees are leaving or not returning to restaurant jobs: wages and benefits, challenges related to childcare or family care, opportunities offered by other industries (closely linked to higher pay) and concerns related to their mental and physical health.

Restaurant companies seem to be adapting quickly to find a solution to the challenge. Hourly wages have recently begun accelerating at a rapid pace. The median hourly wage for team members in limited-service brands increased by 10% year over year in Q2, a sharp increase from the 4.1% growth seen in the first quarter. In the case of full-service restaurants, line cook hourly wages grew by 6.0% year over year in Q2, also a significant increase from the 4.6% growth recorded for the previous quarter.

More than just base pay is being increased. Black Box Intelligence’s 2021 Total Rewards Survey report that was just published revealed the percentage of companies offering referral bonuses, spot bonuses, service/tenure awards, and 401K plans to their restaurant hourly employees has increased compared with the 2019 norm. There is an increase in benefits offered as well.

Macroeconomic Outlook Remains Cautiously Optimistic for Restaurants

Commentary provided by Joel Naroff, president of Naroff Economic Advisors

A variety of issues face the economy currently. Growth should moderate, though it could take twelve to eighteen months before a more normal expansion pace is reached. Significantly fewer jobs were created in August than expected, but that was not as disappointing as it may seem on the surface. A single month’s number is often misleading. The over one million positions added in July were unsustainable. For the three months ending August, the economy averaged 750,000 new jobs, a massive increase. Though payroll gains should moderate further over the next six months, businesses should keep hiring. That would keep pressure on wages, which is good and bad.

With more people making more money, restaurant demand should remain solid, even with the supplemental unemployment payments ending. But that also means higher operating costs and greater worker turnover. Also, the supply chain issues are not likely to be resolved until well into next year, so expect commodity costs to continue rising. Finally, how long the Delta variant will continue to play havoc with in-person dining is unclear. The outlook for the restaurant industry is guardedly optimistic. A strong economy should prop up business, but labor and input cost pressures, coupled with the virus mean that operators should plan cautiously.

Looking Ahead

September may look similar to August for sales and traffic given that many of the underlying conditions remain the same. Positive same-store sales growth is the expectation, but the industry will likely not return to the average 7.6% growth rates we saw in June and July. Guest traffic will continue experiencing negative traffic growth, while average check continues growing at a historically high pace, lifted by the inflationary pressures from rising labor and commodity costs.

Another factor that will significantly affect restaurant results in some areas of the country is Hurricane Ida’s aftermath. Louisiana’s sales plummeted during the last week of August, and that included just the first day when the storm hit the coast. This will undoubtedly create a drag on restaurant sales during the month.

Staffing challenges are also expected to continue through September. But with the expanded benefits expiring for everybody throughout the country, and perhaps more importantly, restaurants beginning to aggressively offer more competitive employee rewards and incentives, we expect restaurants to begin moving the needle in improving staffing levels. However, it definitely won’t be an easy fix, and staffing difficulties and their impact on restaurant execution will continue to be an important underlying condition hindering the industry.