2023 Restaurant Industry Overview

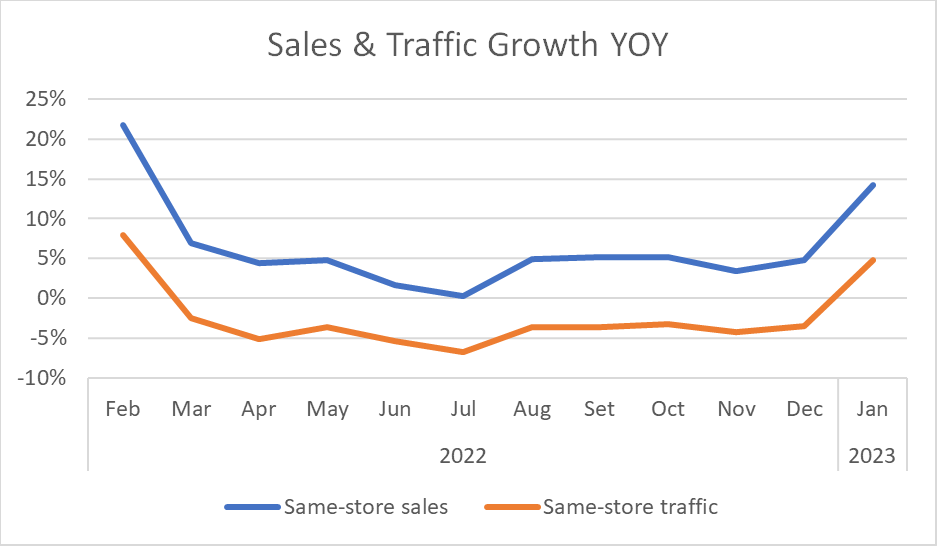

On the surface, 2023 started extremely well for restaurants, with sales and traffic growth experiencing a remarkable improvement compared with previous months. Unfortunately, this strong upswing was completely predictable and explained by the industry lapping over the worst month of the Omicron swell in January of 2022, when the number of Covid cases reached numbers not ever seen before or after that month. As a result of these easy comparisons, same-store sales jumped to +14.2% year over year in January 2023, up 9.3 percentage points compared with the previous month’s growth rate. Similarly, same-store traffic growth accelerated to +5.0%, an improvement of 8.5 percentage points compared to December. This was the best month for year-over-year sales and traffic growth for the industry since February of 2022. It was also the first time during that same period that the industry was able to achieve positive traffic growth.

All industry segments experienced a strong rebound in their same-store sales growth as a consequence of the tailwinds from the Omicron downturn a year ago, but clearly, the biggest winners from this easier lap in the comparisons were full-service restaurants. Not only did they see the biggest improvements in their sales growth compared to December, but they also were the top performers during January based on year-over-year sales growth. The top-performing segments during the month were fine dining, family dining, and upscale casual. The segments with the softest sales growth were those in limited service: quick service and fast casual.

However, looking at growth rates calculated over three years reveals a different story for the industry. Same-store traffic growth for January 2023 compared with the same month in 2020 was the weakest 3-year traffic growth in the last 10 months. Same-store sales growth calculated based on 3-year comparisons is also showing signs of deceleration, although it has held up better due to rising guest check growth.

The Power of Generating a Larger Volume of Online Restaurant Reviews

However, quantity is not the only metric to measure. Quality is just as important. The same Trip Advisor survey found that 33% of diners refuse to eat at a restaurant with less than 4 stars, and 31% of diners would pay more at an establishment with positive reviews.

Based on analysis by GuestXM’s Market Intelligence, full-service restaurants that improved the average star rating of their reviews saw their traffic decline by only 2% year over year in 4Q 2022. Companies with a dip in their average star rating saw a 4% decline.

If we broaden the period, the contrast is even greater. Brands that improved their average star rating saw their traffic increase by 3% compared with the same period 3 years ago, while those with a negative change had a 1% decrease. This underlines the importance of online reputation management. Brands finding ways to maximize good reviews offers a powerful way to drown out bad ones.

In the age of social media, online reviews are equivalent to word of mouth. And when one opinion can be seen by thousands, word of mouth has never mattered more.